"The transfer of wealth from baby boomers to their heirs is expected shake things up in the property market." - Matthew Lapish, Senior Investment Analyst

The demographic landscape of Australia is undergoing a significant shift.

We've been living in the Baby Boomer era for quite some time now.

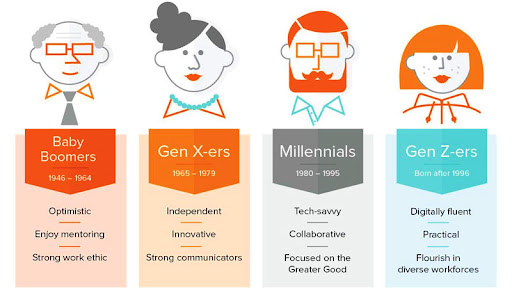

You know, those folks born between 1946 and 1965, right after World War II?

I know because I’m one of them and we’ve been a pretty big deal, shaping our economy, our society, our need for housing and our property markets, and pretty much everything in between.

But now Baby Boomers are starting to retire, and that's causing some significant changes.

The Baby Boomer generation, often referred to as a "bubble" due to its large size, has been a driving force in shaping Australia's economy and society.

Their needs and wants required more resources such as more and larger schools, houses, hospitals, and cars, and Australia’s economy expanded rapidly as it consumed to catch up to the needs of this new generation, and the infrastructure of our country grew to support it.

Then as the Boomers grew up, they needed education resulting in an expansion of the university system.

As they then moved into work, the workplace had to accommodate a workforce that was not just larger from population growth which was further amplified by the inclusion of women in the workforce.

Over time advancements in healthcare and medical technology led to an increase in life expectancy, and our governments became aware of the growing need to plan for the fact that pension and aged care systems were going to have to digest age care demands that were simultaneously going to be more expensive and over longer time frames than what the previous pension system was designed to support.

This gave rise to the Superannuation System that all working Australians have to contribute to today.

It also led to an enthusiastic immigration policy to ensure we had more tax-paying workers to support “the system.”

However, as the Baby Boomer bubble begins to deflate, we are on the cusp of an intergenerational change.

Within five years, all Baby Boomers will be eligible for retirement, and by 2029, the first of the Baby Boomers will reach their statistical age of death.

As they move into their golden years, they will place a significant financial burden on the younger generations.

With the average superannuation balance for those in the 60-64 age group being $323,000, many will eventually need to go on a pension while others will place an extra burden on our already overworked health care system.

That’s one of the reasons I can’t see our government slowing down immigration – we need more young taxpayers in Australia to replace those leaving the workforce.

Having said that, many baby boomers help accumulated significant wealth which will lead to…

According to various studies and projections, Australia is set to witness an unprecedented transfer of wealth in the coming decades as a substantial amount of wealth is expected to gradually pass from the older baby boomers to their heirs, primarily Gen X and Millennial generations.

It is estimated that over $3 trillion will change hands within the next two decades, making it one of the most significant intergenerational wealth transfers in the country’s history.

This transfer of wealth, largely tied up in property and superannuation, will have profound implications for Australia's property market.

Baby Boomers have been the most prosperous generation in Australia's history.

They've benefited from a period of unprecedented economic growth, stable employment, and significant increases in property values.

As a result, they've accumulated substantial wealth, much of it tied up in the family home, and many own their homes outright – they were bought years ago and the mortgage has long been paid off.

This wealth transfer could provide a financial boost to younger generations, enabling them to enter the property market, upgrade their existing homes or buy investment properties.

Of course, this wealth transfer could exacerbate existing wealth inequalities.

Those with wealthy parents are likely to receive a larger inheritance, potentially widening the gap between the property 'haves' and 'have nots'.

This could lead to an even greater divide between property owners and renters.

In conclusion, the impending wealth transfer from the Baby Boomer generation will undoubtedly have significant effects on the Australian property market.

While the exact outcomes are uncertain and will depend on a variety of factors, it is clear that this demographic shift will shape the property market for years to come.

Source: Your Investment Property

Yardney, M. (2023, August 7). The demographic shift: Aging baby boomers and the impending intergenerational wealth transfer. Yourinvestmentpropertymag.com.au. https://www.yourinvestmentpropertymag.com.au/news/impending-intergenerational-wealth-transfer