Overview: "Important factors are now falling into place for the Australian housing market to rise this 2020. Brisbane may fulfil predictions as a top performer for the year."

Property group Domain has revealed its latest 2020 forecast, and it’s nothing if not optimistic about the market.

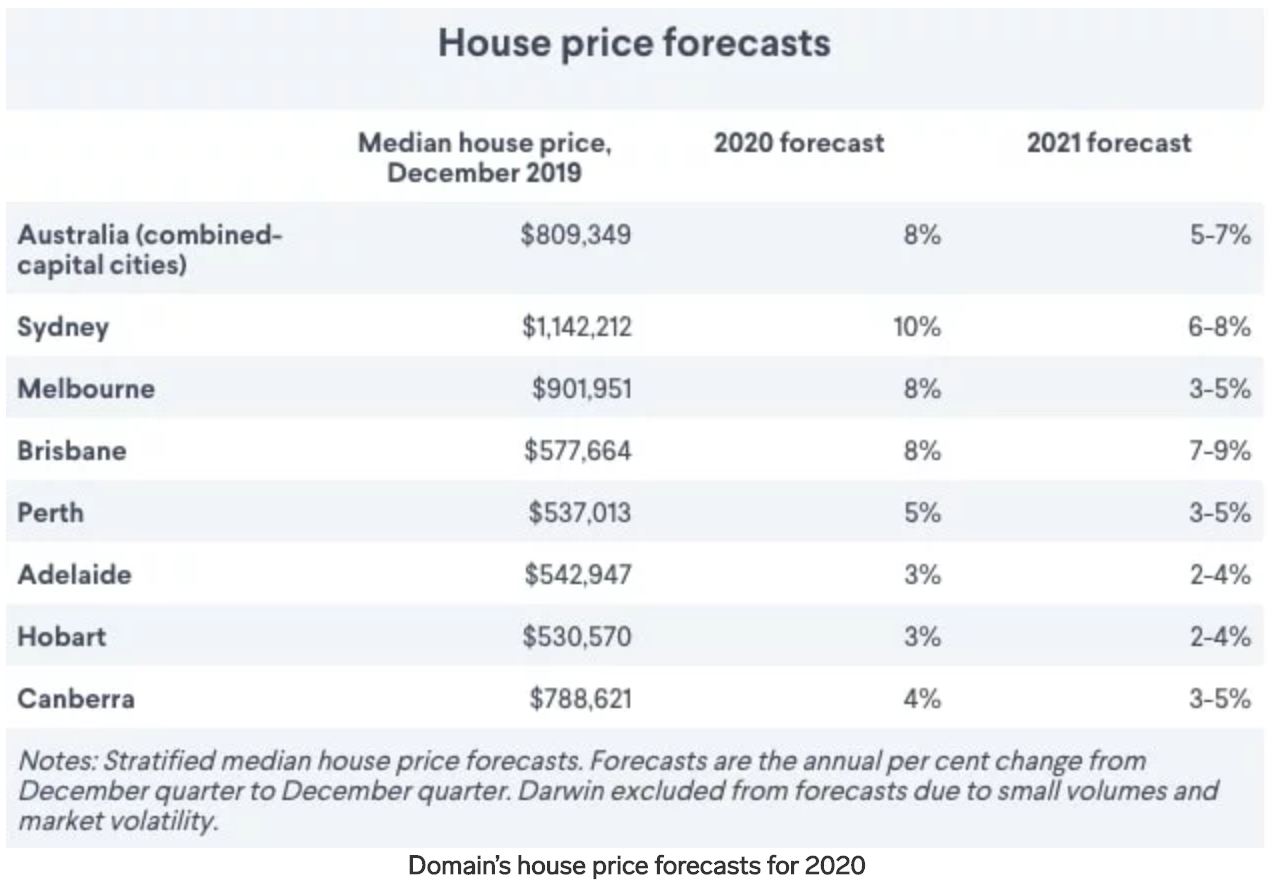

“We’re forecasting Sydney and Melbourne prices to rise rapidly in 2020,” Domain economist Trent Wiltshire wrote in the latest report on Wednesday, while noting the market would be more moderate in 2021.

“Very low-interest rates and the expectation that interest rates will remain low will be the key drivers of rising property prices in 2020.”

Wiltshire also pointed to strong population growth, slowing construction leading, increasingly constrained supply, as well as the government’s First Home Loan Deposit Scheme as pushing prices up.

Domain expects Sydney to lead the pack, adding a further 10% onto prices as it continues its recovery along with Melbourne, which is expected to grow by 8%. If those expectations come to pass it would push Sydney’s median price to over $1.25 million – or 5% above its 2017 peak – and Melbourne’s close to $1 million.

“Prices rose rapidly in Sydney at the end of 2019, particularly in higher-priced areas, with this momentum continuing into 2020,” Wiltshire wrote.

In fact, 8% seems to be the magic number. Prices both nationally and in Brisbane are set to grow by that figure. Perth, where the property market has been ailing for years, is also tipped to see “the fastest price growth since 2014” at 5%.

While those priced out the market might be incredulous the market could go so much higher, the latest data appears to support it. On Tuesday it was revealed new home lending shot up 4.4% in December last year, as low-interest rates attract homebuyers like moths to a flame. Meanwhile, the trajectory of prices nationally is on track to become the “fastest market recovery on record”, according to researcher CoreLogic.

Hobart’s market, for example, which grew by an astounding 16% last year, is expected to run out of steam a bit in 2020, adding just 3% this year. That’s in line with Adelaide’s growth expectations while Canberra will put on 4% by Domain’s estimates.

When it comes to units, Sydney is similarly tipped to lead the pack at 8% growth. It’s followed by Brisbane at 6%, then Melbourne and Perth at 5%.

Investors and homeowners better not grow accustomed to that level of boom, however. Each market is expected to enjoy far more moderate growth in the following year, as prices find their inevitable roof. While property might be hot, wage growth certainly is not.

“The combined capital city median house price is forecast to rise by 8 per cent in 2020. In 2021, house and unit price growth should moderate due to stable interest rates and as affordability constraints bite,” Wiltshire said.

“A pick-up in housing construction from late 2020 or early 2021, as well as more new listings, will also limit price rises.”

Of course, it’s not an exact science. Domain did, after all, forecast Melbourne prices to drop 1% last year. They instead jumped by 9%. So while you’d be right to take its predictions with a grain of salt it is worth understanding what factors are at play

In the meantime, you’ve no choice really but to hang on for the ride.

Source: https://www.businessinsider.com.au/house-prices-australia-domain-2020-2

Derwin, J. (2020, February 12). Australian house prices are tipped to keep rising this year, with Sydney expected to soar by a massive 10%. Retrieved from https://www.businessinsider.com.au/house-prices-australia-domain-2020-2